Shopping for a new home is an exciting time for many Floridians, but few know that the home they choose could make or break their home insurance rates.

Whether you’re searching for an already built home or planning to construct one from the ground up, there are some important factors to consider before you purchase your dream home.

How Old Is It?

An older home may be charming and filled with snippets of Florida’s history, but it can also cost more to insure. This is because older homes tend to develop problems more often than newer ones. If you choose to purchase an older home, you can help reduce your home insurance rate by making renovations designed to prevent common problems associated with electrical wiring, plumbing, roofing, and foundation. Before starting any renovations, consult with your home insurer to make certain.

Additionally, many Florida home insurance companies offer discounts for purchasing a new home because new structures are generally built with the latest safety codes. In 2001, the state implemented the Florida Building Code, which was designed to protect lives, help reduce property losses in a major storm, and provide a guide for home insurance companies to determine rates.

Improvements under the Florida Building Code include:

• Better structural design requirements to withstand greater wind pressures in South Florida and most coastal areas

• Wind-borne debris protection required on windows in all coastal areas and South Florida

• Improved roof covering systems requirements

• Approval system that ensures that products comply with wind resistance and impact resistance requirements

• Improved window performance labeling requirements

A 2005 study conducted by the University of Florida revealed that homes built in 2002 or later sustained less damage from hurricanes than homes built between 1994 and 2001 under the Standard Building Code. Homes constructed prior to 1994 fared even worse.

The study found that shingle-roofed homes built under the Florida Building code experienced less shingle damage than homes built under the 1994 code. This is critical in hurricanes because loss of too many shingles can compromise the roof and allow rain to enter the home.

The study also discovered that none of the homes built after the requirement for reinforced garage doors sustained significant garage door damage. Meanwhile, garage doors on most homes built prior to 1994 were blown off their tracks, which allowed wind to enter the house and undermine the integrity of the roof from inside.

What Building Materials Were Used?

The materials used to build your home can also influence your home insurance rate. For example, it’s more expensive to insure a wood frame home than one constructed out of brick. Homes made out of wood materials are more prone to fire and wind damage, making them a greater risk than brick homes that are built to withstand these types of hazards.

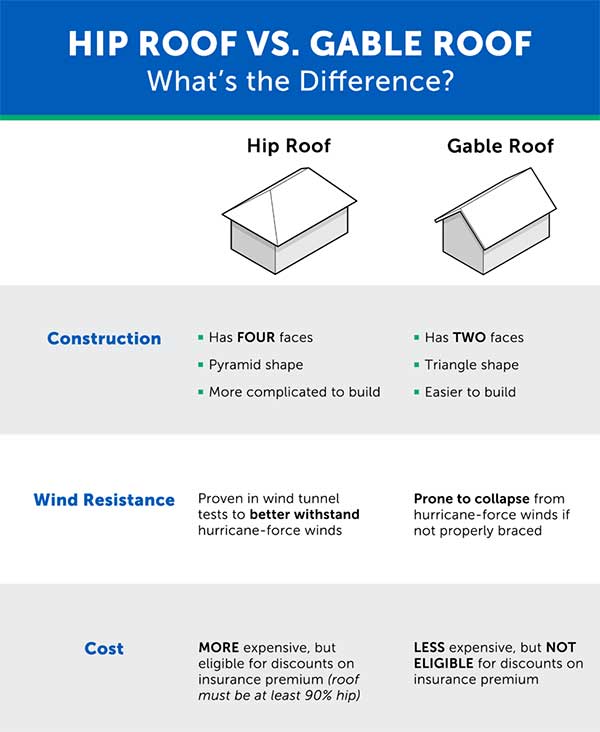

Hip Roof vs. Gable Roof: What’s the Difference?

The roof is your home’s first line of defense against wind, hail, wildfire, and other hazards, and it is considered the most important part of a house to home insurers. Once a home’s roof is breached, it increases the risk of more serious damage claims. This is why the shape of a home’s roof plays an important role in determining homeowner’s insurance rates in Florida.

Let’s take a look at the most common types of roof shapes – hip and gable

Where Is the Home Located?

Where is the Home Located?

Location significantly impacts homeowner’s insurance rates. Florida’s relatively expensive homeowner’s insurance rates can be attributed to the moderate to high risk of hurricanes, floods, and sinkholes throughout the state, and coastal homes may pay higher premiums to compensate for the elevated risk. Consider distance to the shore as you factor in possible insurance costs.

On the contrary,if your home is located within five miles of a fire station or 1,000 feet of a fire hydrant, your home insurance premium may be lower. Take a moment to determine the distance between your house and these features and provide them to your insurance agent.

What Features Are Included?

Certain features of your home can increase your insurance rates, while others are eligible for discounts.*

Features That May Increase Insurance Rates

- Inground swimming pool

- Hot tub

- Custom decorative features

- Extensive landscaping

- Fireplace or wood-burning stove

- Deck

Features That May Decrease Insurance Rates

Features That May Decrease Insurance Rates

- Alarm system (burglar and/or fire)

- Gated entrance

- Wind mitigation

*Not all homeowners insurance companies offer the same discounts or use the same criteria to evaluate whether or not a home is eligible for discounts.

I'm Liz, and I specialize in matching our agency's customers with the best and cheapest car insurance quotes in Tampa and all across our great state of Florida. Of course, we don't just provide the best rates on

I'm Liz, and I specialize in matching our agency's customers with the best and cheapest car insurance quotes in Tampa and all across our great state of Florida. Of course, we don't just provide the best rates on  Here is what you need to remember about Tampa.

Here is what you need to remember about Tampa.

In Tampa, just as in any city across Florida, location is a determining factor in computing auto insurance rates. The crime rate of a particular neighborhood, it's driving condition and historical data on accidents will all be taken into consideration.

In Tampa, just as in any city across Florida, location is a determining factor in computing auto insurance rates. The crime rate of a particular neighborhood, it's driving condition and historical data on accidents will all be taken into consideration. The most expensive zip code for

The most expensive zip code for

I'm Conrad, owner and operator of a leading Boca Raton Insurance Agency. If you live, work and play in Boca Raton, and you are looking for low rates on car insurance then you owe it to yourself to call me or any one of my licensed agents.

I'm Conrad, owner and operator of a leading Boca Raton Insurance Agency. If you live, work and play in Boca Raton, and you are looking for low rates on car insurance then you owe it to yourself to call me or any one of my licensed agents. Where you live in Boca Raton, FL will also affect auto insurance rates as location can affect driving environment. Insurance companies take a careful look at driving conditions in order to assess a particular neighborhood safety data. Risk of theft, residential street parking as opposed to garage parking all play a role in the eyes of the insurance company. So do other factors such as a driver's credit score, or the presence in a vehicle of an of an alarm or anti-theft device

Where you live in Boca Raton, FL will also affect auto insurance rates as location can affect driving environment. Insurance companies take a careful look at driving conditions in order to assess a particular neighborhood safety data. Risk of theft, residential street parking as opposed to garage parking all play a role in the eyes of the insurance company. So do other factors such as a driver's credit score, or the presence in a vehicle of an of an alarm or anti-theft device Of course, this is where we come in. Having provided you with your list of options, and explained the pros and cons of each one of these extra layers of protection, we will match your choice with your budget and recommend the most suitable auto insurance company in Boca Raton, FL. Our friendly agents are standing by to answer any question you might have. They will provide you with all the information you need, drawn from multiple insurance companies so that you may make an informed decision.

Of course, this is where we come in. Having provided you with your list of options, and explained the pros and cons of each one of these extra layers of protection, we will match your choice with your budget and recommend the most suitable auto insurance company in Boca Raton, FL. Our friendly agents are standing by to answer any question you might have. They will provide you with all the information you need, drawn from multiple insurance companies so that you may make an informed decision.

It’s a reasonable assumption that the more expensive a home might be, the move it will cost to repair/rebuild it when tragedy strikes. And thus, Florida Homeowners Insurance costs are largely driven by the type of home you live in. In Florida, homeowners typically live in any the following five types of residences:

It’s a reasonable assumption that the more expensive a home might be, the move it will cost to repair/rebuild it when tragedy strikes. And thus, Florida Homeowners Insurance costs are largely driven by the type of home you live in. In Florida, homeowners typically live in any the following five types of residences: