Caring for your home and loved ones is crucial. That’s why we offer homeowners insurance you can depend on. From dwelling coverage to personal property protection, we provide homeowners insurance policies to suit your needs and budget. Homeowners’ policies cover:

- Dwelling – Coverage that protects the structure of the home (roof, walls, wall-to-wall carpeting, etc.)

- Other structures – Coverage for sheds, detached garages and other structures not connected to the main dwelling itself

- Personal property – Coverage for personal items (clothing, furniture, appliances, computers, etc.) on and off the premises

- Loss of use – Coverage for when an insured has to move out of the home while repairs are made as a result of damage caused by a covered loss

Home insurance can also be used as a means of financial protection. If someone sues after being injured on your property, proper home insurance limits can ensure you won’t be paying their legal fees from your pocket.

We also offer insurance policies for owners of second homes and vacation homes. This way, you, your family and your guests are protected wherever you go.

Homeowners insurance and financial standing

If you own a home and have a mortgage, your lien holder (the bank who is invested in your loan) will likely require you to carry insurance on your home. We often partner with banks to allow members to combine their insurance payments and monthly mortgage bill. This is called escrow. Your agent will be happy to review the details with you.

The average cost of home insurance in Florida is $1,727 per year.

You could save $1,000 or more by comparing quotes from multiple companies.

To find the best homeowners insurance in Florida, we reviewed major insurers and collected thousands of Florida quotes. Progressive ASI offered the cheapest rates, but we recommend homeowners also compare service and coverage from different home insurers to find the best coverage in Florida.

The cheapest home insurance companies in Florida

We surveyed 14 of the largest homeowners insurance companies in Florida in order to find the companies with the best rates. In our research, we collected quotes for a home with $214,000 of dwelling coverage — the median value of an owner-occupied home in Florida — for every ZIP code in the state.

We found a surprising range of premiums. The cheapest Florida home insurance companies offered rates well under $1,000 per year — $519 at Univeral North America and $717 At Progressive ASI

What risks do homeowners face in Florida?

Florida’s position on the Gulf Coast leaves it vulnerable to several major insurance perils, resulting in the highest homeowners insurance costs in the nation. If you live in Florida, we recommend insuring against the most common and expensive perils when buying home insurance.

Wind damage

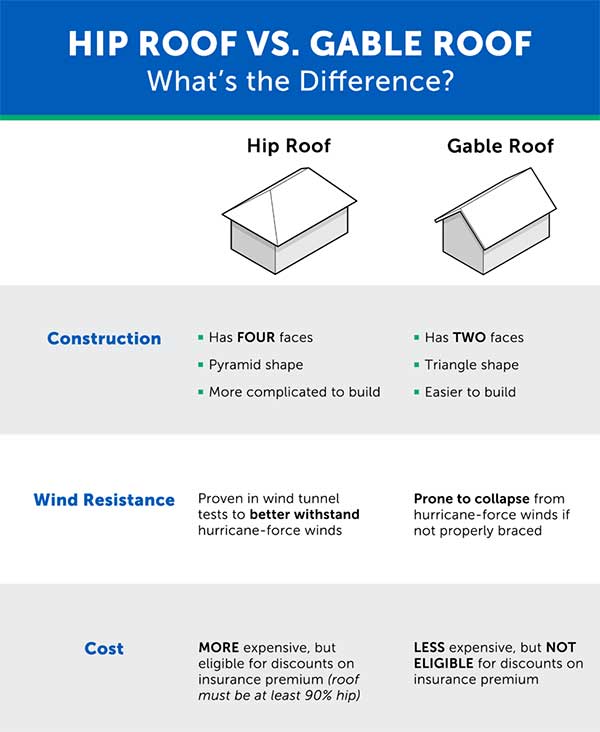

High winds caused by storms and hurricanes are one of the most frequent and costly causes of property damage in Florida. Fortunately, wind damage is almost always covered by any homeowners insurance policy. However, some coastal homes that are especially susceptible to wind damage may need to purchase a special wind endorsement.

The good news is that state law requires insurers to offer discounts for homeowners who purchase and pass an optional wind mitigation inspection. You’ll receive a list of ways to reduce your home’s risk of storm damage, and if you pass, you’ll get a home insurance discount that more than makes up for the inspection cost.