Cost of commercial property insurance

The size of your building, the value of your equipment, and other factors help determine the cost of property insurance (also called hazard insurance).

Median costs for Insureon customers

The median cost of commercial property insurance is $63 per month or $755 per year with a limit of $60,000 and a median deductible of $1,000. The median offers a more accurate estimate of what your business is likely to pay than the average cost of property insurance because it excludes outlier high and low premiums.

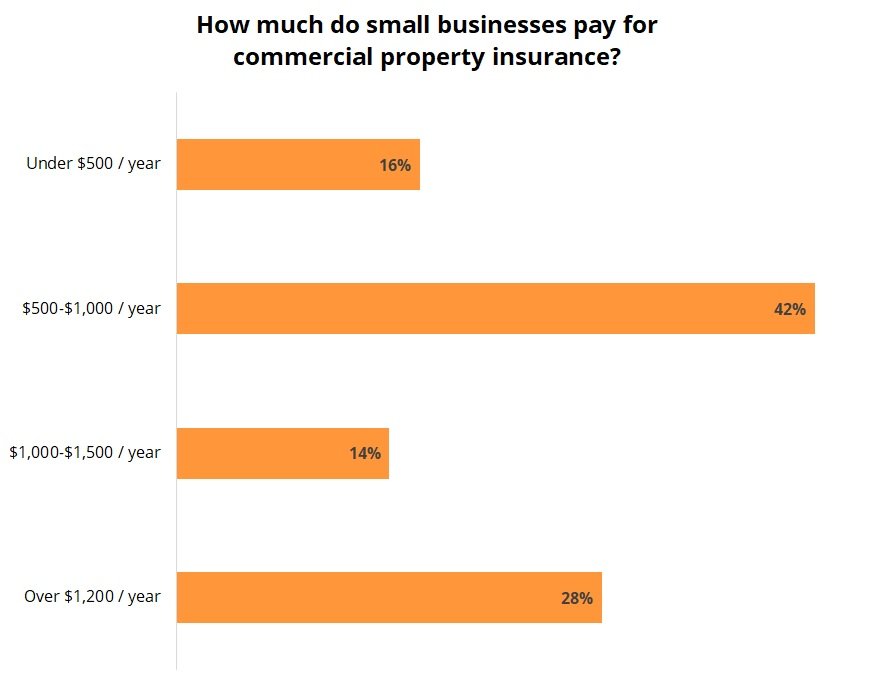

Many Insureon small business customers (16%) pay less than $500 per year and 42% pay between $500 and $1,000 annually for property insurance. However, most customers opt for a business owner’s policy, which combines commercial property insurance with general liability insurance at a discount.

Factors that impact property insurance costs

Geography. This can help your provider determine which environmental risks your business may face, such as flooding, tornadoes, etc. Land value and local law can also affect what premiums you pay.

Size of business premises. A large office or factory building will likely cost more to insure than a single rented room.

Safety and security. Is your business located in a high-crime area? Does your business possess toxic materials or engage in dangerous activities like mining? Do you have stringent security measures? These can all affect insurance rates.

Age of building. Old buildings can be more susceptible to certain types of damage, so they may cost more to insure. For example, a fire caused by old electrical wiring could translate into costly repairs.

Fire protection. Property with easy access to a fire department and fire hydrants may cost less to insure. Sprinkler systems and fire alarms help reduce insurance costs, too.

Type of equipment. Heavy industrial equipment will cost more to insure than an at-home business’s sewing machine.

Age of equipment. You may pay higher premiums if your equipment is hard to repair because of scarce parts, or if it’s more likely to break down because of heavy use. Alternatively, it might be cheaper to repair older equipment than buy state-of-the-art technology.

Property valuation method. Replacement value coverage costs more than actual cash value coverage. The former pays out for the cost of a brand-new item, while the latter pays out for the item’s depreciated value.

Types of hazards covered. A policy that covers open perils costs more than a policy that covers named perils. Open perils coverage protects against all losses except those specifically excluded in the policy. Named perils coverage only protects against losses listed in the policy.

Bundle property insurance in a BOP for savings

To save money, many small business owners opt for a business owner’s policy (BOP). A BOP combines commercial property insurance with general liability insurance at a lower rate than purchasing each policy separately. Fill out Insureon’s free online application to compare quotes for a business owner’s policy.